岭南观点·27 金融体系扭曲、经济转型与渐进式金融改革

张一林副教授、林毅夫教授、朱永华博士

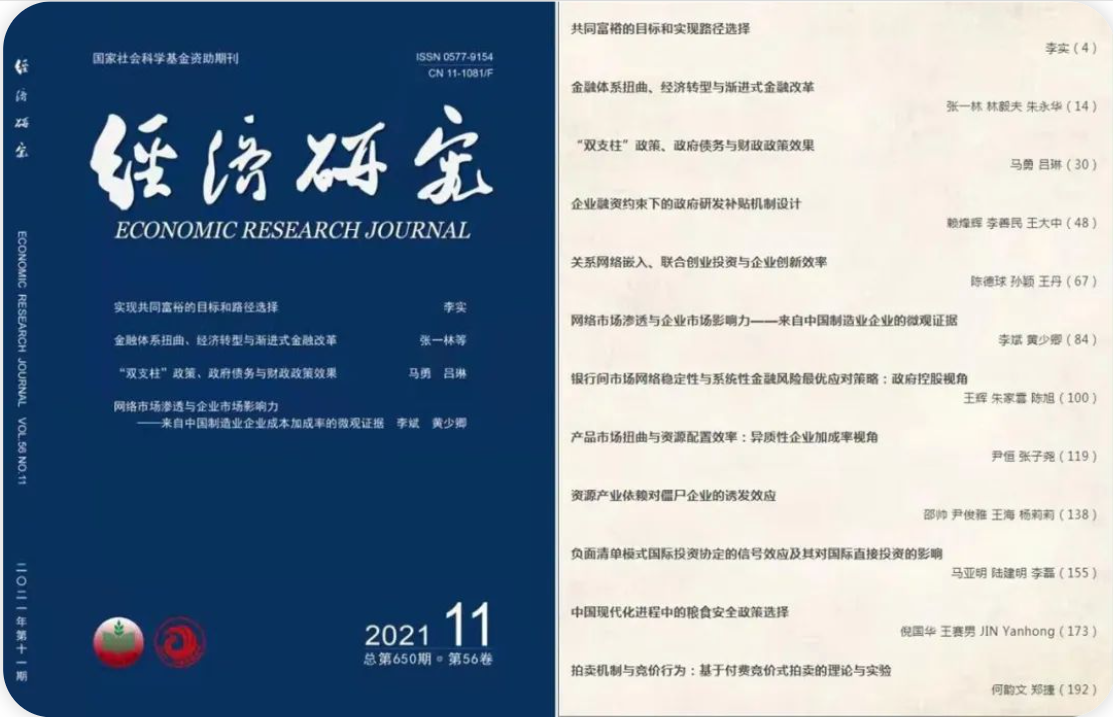

我院张一林副教授与北京大学林毅夫教授、朱永华博士合作的论文《金融体系扭曲、经济转型与渐进式金融改革》于2021年11月在经济学中文顶级期刊《经济研究》发表。

自上世纪七十年代金融自由化理论产生至今,不断有来自各界的声音主张转型国家应当根据金融自由化理论,一步到位去掉各种的金融抑制政策,快速建立起与发达国家一致的金融制度安排。但是,对于转型国家而言,这是否是金融改革和金融发展的最优选择?

大量转型国家实施“休克疗法”的失败教训表明,激进地消除扭曲并照搬发达国家的经济金融制度的做法,并不适合发展中国家。以智利为代表的拉丁美洲国家于上世纪七八十年代按照金融自由化理论的政策方针,开展了以自由化、市场化、私有化为导向,以英美等发达国家为模板的金融改革,但改革的结果令人大失所望。反观中国,改革开放以后也开启了以市场化为导向的金融改革,但不是简单照搬欧美经验,也并非是全盘私有化和自由化,而是以一种渐进温和的方式逐步推进。改革至今,中国未发生系统性的金融危机,金融体系基本保持平稳,经济长期稳定增长,金融体系的竞争力和效率不断提升。

显然,用金融自由化理论,既无法解释拉丁美洲国家金融改革的失败,也无法解释中国渐进式金融改革所带来的稳定和经济绩效的不断提升。鉴于此,本文基于信息不对称环境下银行和以追求经济增长与社会稳定为双目标的政府的博弈模型,讨论金融抑制的产生根源,以及转型国家成功推行金融改革的必要条件和适宜方式。

文章的主要研究结论、政策含义和可能的学术贡献包括:

(1)转型国家金融体系中各种看似不合理的扭曲性制度安排,本质上是限制条件下的“次优”选择。许多转型国家在历史上的特定时期出于特定目的推行了违反比较优势的赶超战略或进口替代战略,以致在转型初期,经济中有大量前期战略遗留下来的,为国防安全、国计民生和社会稳定所需,但是因违反比较优势而不具有自生能力的企业。政府需要不断给予这些“重要而不能倒但不补贴就要倒”的企业保护补贴,以防其破产倒闭引发社会动荡或危及国防安全和国计民生。转型国家金融体系中的各种扭曲性制度安排,本质上是政府通过扭曲金融体系来暗补那些“重要而不能倒”的企业。

(2)转型国家要成功推行金融改革而不引发动荡,应当以改善企业自生能力为基础前提,而改善企业的自生能力,应当通过发展符合比较优势的产业,以此加快本国的资本积累和比较优势的转变,让过去不具有自生能力的企业变得具有自生能力,根据企业自生能力的状况制定阶段性的改革目标和改革方式。

(3)九十年代我国银行业的技术性破产有着深层次的原因。一方面,改革初期大量国有企业不具有自生能力,经营绩效不佳,其贷款本身就有很高的概率成为坏账。另一方面,当银行肩负起为缺乏自生能力的国有企业提供贷款的责任时,银行也就分担了国有企业的政策性负担,政府难以对银行的资产质量有严格的要求,甚至补贴银行的亏损,银行的预算约束变软,引发严重的道德风险问题,进一步恶化银行的资产质量。国有企业缺乏自生能力与政府对银行业的监管不严格不完善的问题,共同引致了九十年代中国银行业的巨额不良贷款问题,而对银行监管的扭曲又内生于为缺乏自生能力的国有企业提供暗补的需要。

Summary

Since the emergence of the financial liberalization theory in the 1970s,there have been persistent voices from all walks of life advocating that transition economies should remove all kinds of financial repression policies in one step and arrange a financial system consistent with developed countries. But is this the best option for countries in transition with respect to financial reform and financial development?

The failure of the large number of transition economies which implemented shock therapy and the success of China's dual-track progressive reforms have shown that radical elimination of distortions and copying the economic and financial systems of developed countries is not appropriate for developing countries. In the 1970s and the 1980s,Latin American countries,represented by Chile,carried out financial reforms which were oriented towards liberalization,marketization, and privatization,and modeled on developed countries such as the United States and the United Kingdom,but the results of the reforms were disappointing. On the contrary,since the reform and opening-up in 1978,China has also started marketoriented financial reform. Instead of simply copying the experience of developed Coundvies and implementing comprehensive privatization and liberalization,China's financial reform was conducted in a gradual and moderate way. Up to now,China has not experienced a systemic financial crisis,the financial system has remained basically stable,the economy has grown steadily,and the efficiency of the financial system has been continuously improved. Clearly,the theory of financial liberalization cannot explain either the failure of financial reform in Latin American countries or the stability and economic performance brought about by China's progressive financial reform. In view of this,this paper takes the soft constraints of the banking sector as an example to discuss the root causes of financial repression,and the necessary conditions and appropriate methods for the transition economies to successfully implement financial reforms in a theoretical framework.

This paper points out that the financial repression policy in transition economies is essentially a constrained second best. Governments in many transition economies have implemented the catch-up strategy or import substitution strategy which violates their comparative advantages. Therefore,in the early stages of the economic transition,there are many nonviable firms left over from the former strategy,and these firms are necessary to national defense security,national economy,people's livelihood and social stability. The government needs to constantly subsidize these firms which are too important to fail,for which financial repression policy occurs as a system arrangement to subsidize these firms secretly. Based on the circumstances of the transition economies,imposing financial repression policies is rational and even necessary in a particular period. The reason why developed countries do not have a lot of financial restraints is that most their industries possess comparative advantage,and most firms can survive even without subsidies from the government. As for a small number of defense security industries that violate comparative advantage and need subsidies to survive,direct fiscal subsidies can be used,without the need to distort the financial system.

This paper proposes that to carry out financial reform smoothly,transition economies should first improve the viability of firms by developing industries that meet the comparative advantages so as to speed up capital accumulation and transformation of comparative advantages,and then formulate phased reform goals and adopt progressive reform methods according to firms' viability. This kind of progressive financial reform,compatible with the economy's factor endowment structure and comparative advantage,can avoid the economic collapse caused by the financial reform and achieve the goal of supporting economic growth,which makes it a better way of financial transformation than shock therapy.

张一林

中山大学岭南学院“百人计划”副教授、博士生导师、博士后合作导师,中山大学新结构经济学研究中心执行主任,中国金融四十人(CF40)青年学者,广州审计学会副会长,广州高层次金融人才。研究方向为新结构金融学和新结构经济学。研究成果发表于《经济研究》(7篇)、《管理世界》(4篇)、《中国工业经济》、《金融研究》、《南开管理评论》等学术期刊。主持国家自然科学基金、教育部人文社科基金、广东省自然科学基金等基金项目。