Curriculum: CHMB5805 Financial Management

Course Description

This course is an introduction to financial management -- how management raises and invests capital so as to create value for the firm’s owners.

Before we can talk intelligently about specific financial management issues, we need to develop a general understanding of:

-

What we mean by firm value

-

What the drivers of firm value are

-

How to measure whether a firm is creating value for its owners

Business transactions in general require current investments with the hope of future payoffs. As such, both time and risk matter -- the timing of the future payoffs and the uncertainty regarding the level of those future payoffs. Choosing investment opportunities that create value for the firm involves a comparison of the estimated future benefits to the current investment, in light of the time and risks involved. Hence, before we can turn to specific financial management issues, we need to develop and understand the tools of valuation for valuing costs and benefits while explicitly considering time and risk.

With an understanding of the tools of valuation, we can then consider some major management issues from a financial perspective. Although we will cover more than a dozen issues from the perspective of how they affect value created for owners, there are essentially just three categories of issues:

-

How should management best consider the value impact of current investments generating uncertain future benefits (investment decisions);

-

How should management best consider the value impact of different options for financing the firm’s investments (financing decisions) and

-

How should management best evaluate its performance relative to creating value for the firm’s owners (performance analysis)

Instructor

Timothy Nantell

PROFESSOR, Finance, CSOM

【 CHEMBA丨Event 】2019-2020 Popular Faculty—“表爷"Timothy Nantell

Sharing

Dear Professor Tim:

I have successfully submitted my final exam to canvas. I don’t worry if I can pass FM course because even if can't pass it this season, I still have another opportunity to meet the professor and study this course again.

In the past month, it was one tough and unforgettable journey of FM course, and it will be one treasurable memory in my life. Books all over the wall, special face background, brand new earphone,purple juice (l guess that's blueberry juice), birthday song, 4 times Zoom meetings, 80 videos, 9 homework and 1 final exam. All of these looks like shining stars of the night sky will always evoke my memories.

Thank you, Professor! Finally, I would like to share my little sense after studying

-

Create value is the most value

-

Flow represents prosperity

-

Continuing Value represents the future

-

People are the core and source of value creation

Best regards to you and family

--- CHEMBA19 Colin ZOU

Financial Management is an Art of Managing for Value Creation

When talking about Financial Management (FM), what ideas come up to you? Numbers? Spreadsheets with lots of professional “names”? Or cool look guys with tie and suit?

As a non-financial background graduate, I have very similar traditional stereotypes in my mind, and feel very intimidated and nervous about taking this course.

Professor Timothy, course instructor, who has profound experience in FM field and taught FM courses for years, is a very humble and patient person – relieves my anxiety.

The key word, professor always spoke in mouth is – VALUE!

And what does exactly the VALUE mean for?

As professor’s introduction video said: the course is trying to build up a mind map of the idea of value-added net present value or value added.

Now, we got two key words: net present value (NPV) and value added.

Please keep them in mind, that’s the objective of the course, the goal for operating a firm, and the principle of our life.

The next question will be how does professor provide VALUE to us?

The secret is 言传 explained by words (via videos and discussion board) and 身教 practice in deeds (by Excel – FAMOUS model), not only in the three weeks course, but also through daily life.

Via the neat and rigorous course structure, professor is trying to decode the basic knowledge and calculations. Totally 14 sections from A1-M9, 78 sessions’ (28+28+22) pre-course videos are extremely friendly to the non-financial graduates.

NOPAC, IC, FCF, PV, TVM, IRR, ROIC, WACC. ROE, EP, SVA, such abbreviations are becoming familiar names like John, Michael, Lily etc. around us.

If we still cannot remember the above names, no worries, professor also prepared the Glossary for the corresponding.

As Prof. Timothy said, he’s trying to build up a set of cohesive related ideas that we can rely on as operating managers and financial managers. For our entire career.

He gives us plenty of practical frameworks to better understand how operating managers and financial managers to think in the same way on creating value to the company.

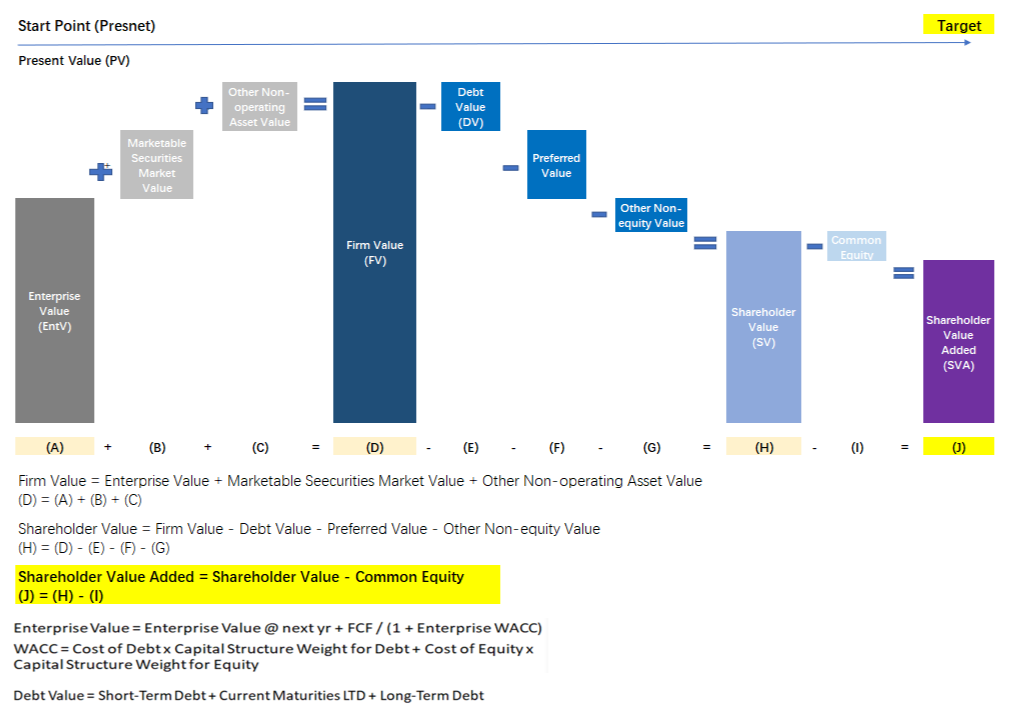

And one of the homeworks is about Shareholder Value Added (SVA).

I read the question again and again and thought about the VALUE and the idea of value creation I learnt from Prof. Timothy, that is a set of cohesive interrelated ideas and is the framework by which strategy and operations should be organized within a firm. And I tried to draw the map of this framework (attached below).

Framework by Joey WU

To execute above framework, FAMOUS model a very strong and powerful tool!

But professor said, beyond FAMOUS, we should use a model to build a model. A model in your brain as opposed to an Excel.

This point touched me, as a non-financial graduate, I misunderstood FM for a long time. Now I consider FM not only numbers/spreadsheets, but the way of thinking: about value creation. No fear, but interest. Useful and practical.

Furthermore, when finishing the FM course, we may also gain an additional Value-added course: Excel – from entry to expert.

Lastly, what’s FAMOUS model copyright registered by Prof. Timothy? For more value added, click below link from Wiki to better understand his famous financial model – FAMOUS (Financial Analysis Modeling Outstanding Unprotected Software)

So, don’t be hesitated to join and enjoy the value-added journey!!

- CHEMBA21 Joey WU

Reference

FAMOUS™ is financial analysis modeling outstanding unprotected software that provides an organized and automated, yet adaptable, system by which financial analysts can carry out five analyses:

-

Analysis of a firm's past financial performance

-

Development and analysis of a firm's future financial plans

-

Estimation of the firm's intrinsic value

-

Investigation of the impact of various proposals/projects on the firm's intrinsic value

-

Using relative valuation tools to test intrinsic values.

Link: FAMOUS FINANCIAL MODELING WIKI / FAMOUS Financial Modeling Wiki (pbworks.com)